All over the world, trade operates based on the credit produced by the current fiat money regime of central banks.

Cemil Şinasi Türün

Paribu Advisory Board Member

All companies, big or small, trust in the money flow that has a hierarchical structure starting from central banks. The US central bank, FED prints money in return for the payment promises made by the US treasury by issuing long-dated bills. 90% of the money we are using today is not cash and it is generated by the reproduction of the bottom money printed by FED. The bottom money is reproduced in the form of debt given to enterprises and households in need through commercial banks. Yet, in the last 30 years, money has gradually lost its link with the real economy in this hierarchical and centralized structure. Eventually, it started to gravitate towards a dangerous fall with the financial crisis in March 2020.

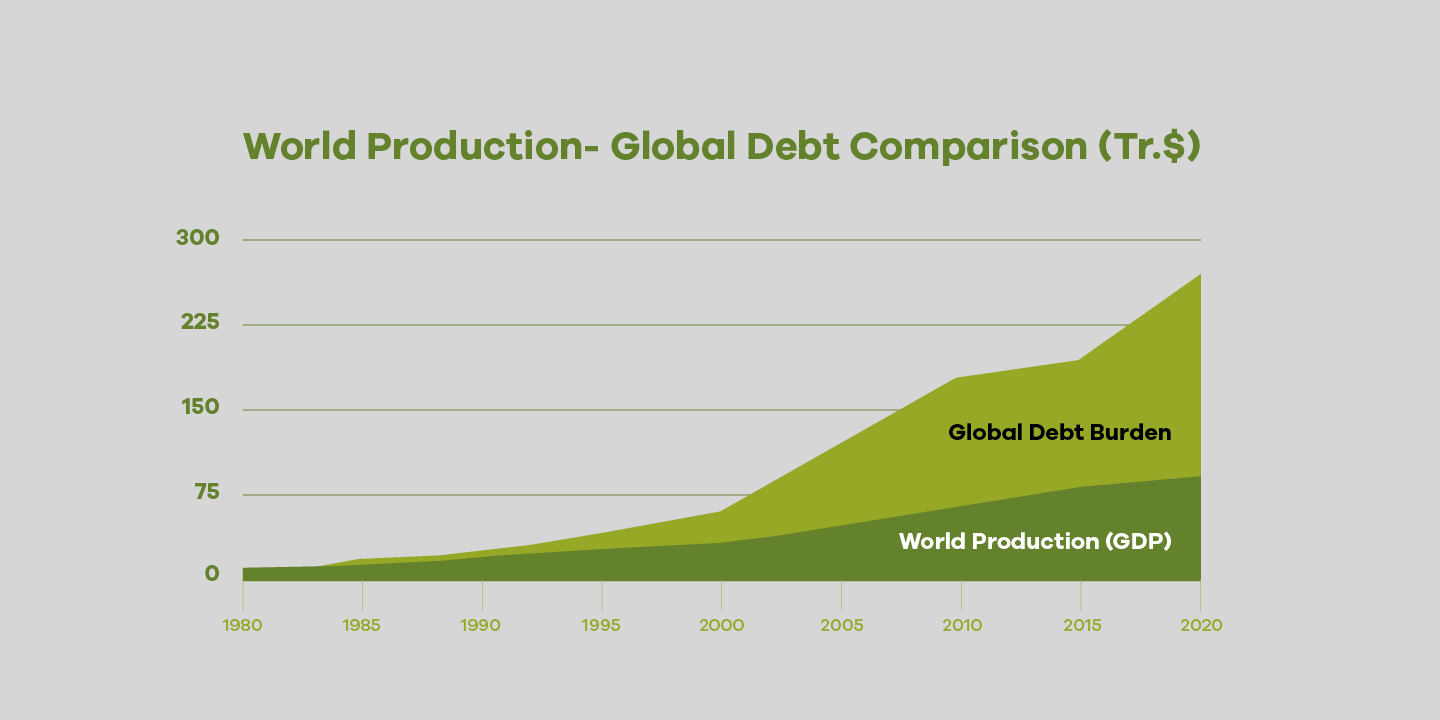

Right before the financial crisis, the global debt in the world had reached 257 billion dollars, which was more than the total production in 2019 even when it was tripled. Please look at the blue part in the visual below. This part marks the difference between the world production (green) and debt burden. Even by looking at this visual only, you can think that our living standards have increased in the last two decades, but this is unfortunately not true.

Comparison of global debt and total world production. (Data: World Bank and IIF)

World Production- Global Debt Comparison (Tr.$)

Global Debt Burden

World Production (GDP)

For which projects has debt been created?

When you look at the visual more carefully, you will notice that the debt burden does not form a curve, but it consists of five different periods that increasingly arch.

You can see that the first of these five periods is the Cold War period between 1980 and 1990, when the debt and production were nearly the same. Between 1990- 2000, seemingly a preparation was made. From 2000 to 2010, there was a debt boom and unreasonably high credits were created. It appears that adventures were funded. In the years following the 2008 crisis, this upwards trend slowed down a bit between 2010 and 2015, and after 2015 there was again a terrible debt increase. The data I used in this table are based on the real figures taken from the websites of the World Bank and IIF (IMF). You can have a look at them yourselves, too. Now, here comes my question: Who created this debt? For which projects was this debt created? Who are the creditors in the end? In these projects, hundreds of thousands of people have lost their lives. Many people have been deterritorialized in several countries. And all these things have happened by putting nature and climate into serious danger.

The Men in Black, namely bankers and financiers who took the role of God created debts on the one side-as I detailed above- and waited in their capacity as creditors on the other side. In the last decades, people have been debited in a lot of ridiculous and resultless adventures and in return there was not an increase but a decrease in our living standards. In this period, there has been a rise in unemployment on a global scale and the income inequality has reached a terrifying level.

What happened to Adam Smith’s invisible hand?

What happened to the famous “invisible hand” that Adam Smith, who is known to be the father of the market economy and capitalism, mentions in his book Wealth of Nations? The invisible hand that regulates the free market economy? Recently, all the rules of capitalism have been ignored in the operations performed by FED. All unsuccessful companies and sinking funds have been rescued by putting extra money. To put it differently, all the players at the poker table were let to win, unexceptionally. These last developments are in fact against the free market mentality. The entire private capital was disappropriated all of a sudden. All capital and production tools in American market (huge companies) were nationalized with the money issued by the state. Most of them, thus, stopped being private property. To do this, American treasury and FED were merged. If this had happened in the past, we would say that America has shifted to socialism. Obviously serious things are happening.at the moment.

When things calm down after a while, the world’s financial system will go through a restructuring. With this resolution accelerated by Corona, there will be big ruptures in the debt table above and the world production will decrease very fast. However, the most important thing this table shows is that to date the game has been played with the ethical rules put aside. In fact, the companies which should have sunk long ago were unethically let to float with the help of cheap credits. The managers of these companies filled their pockets with these cheap credits right in front of us and companies bought their own shares with these cheap credits, which resulted in fake growths. These are all against the rules of free market. They are all amoral. They are unethical.

To sum up, the Men in Black, who we know have done wrong but who still continued their self-appointed and irresponsible acts, are now on the rocks. The world’s financial system is on the brink of collapse. What caused this coming collapse is not just Coronavirus. The world is now different as a consequence of the technological advances, and from now on no can easily be cheated. Up to now, financiers have made a lot of gains with some methods that are called arbitrage. These methods are based on information asymmetry. Information asymmetry means that information does not reach everywhere at the same speed. We envisage that the systems based on such asymmetry will not work from now on.

At this point, we offer a new decentralized money and credit generation system for the future world of trade. We call this new system DEF Protocol. This new system will completely be based on real economy and the ethical rules will unremovably be embedded in it. Besides, there will always be information symmetry and credit will be generated at the margins, that is in a decentralized way based on smart contracts. In doing that, we will use an application which we call super-conductor.

DEF Protocol

The solution that we are announcing in this article is based on a method called “postdated check”. Postdated checks have been present in our country for the last 40 years. In previous years, as Defterhane team, [1] we copied the basic principles of this method and created a protocol based on real economy with the help of smart contracts we had developed on Ethereum for our people and the rest of the world.

We are going to explain the technical details of this new protocol, in which only open sources were used, with a white paper we will publish in a different medium. In this article, we focus on the differences between the protocol and the existing centralized system.

The circles marked with a (P) below show the production and the ones with a (C) show the consumption points. (F) refers to financing, namely banks and financial institutions.

The world’s financial system which was in use till now but went into a crisis in March 2020 has a structure similar to the shape on the left. In this representative picture, there is (F) in all production and consumption relations. The (F) points are in production and consumption circles which rely on the current systematic information asymmetry. In other words, all the producers, e.g farmers, are forced to solve their produce to the people in consumption who are in their close circle and who provide fund. The reason is that the information about consumption points is inaccessible by farmers who are in production. Farmers do not know how many consumers will buy from them, which products they will buy and at what price. (F) benefits from this information asymmetry and apply arbitrage strategies. In other words, they unethically turn this lack of information into a gain. Besides, there also occur interests which are seen as taboo or sin by many people. However, now we are turning the existing architecture based on information asymmetry into a structure that looks like the shape on the right with the help of technological advances, commonly used smartphones and blockchain systems. In this new structure on the right, all producers and consumers will be aware of each other within a superconductive network and the price will be set in a balanced and ethical way satisfying both parties. There will be no unnecessary external element in between.

We will be in a new world after Coronavirus

All these unnecessary people, whom we call “intermediaries” and who stand between producers and consumers in this centralized financial structure which is about to explode, will disappear in this new structure. This disappearance will unfortunately cause a damage in production and consumption and until the superconductive structures, which we have mentioned in this article, are properly positioned, there will perhaps be food problems in the cities and prices will go up.

In the structure we are proposing, the production and consumption wheels will turn in a circular way as shown below and there will be no information asymmetry left. The production and consumption of people will be informed about each other from one end to the other. The letter (M) here refers to the miners that operate this superconductive system as well as the structures that provide all kinds of technical and logistic support. The transportation and delivery of products to the consumption points is in fact an act of production. Any kind of service that helps with production such as packaging, numbering and auditing should be accepted within (P). The sales points and collection units that offer intermediary services in the cities and towns where products are consumed are part of (C), consumption. The shares and profits of all the people serving in this wheel are listed and added systematically so that the price can appear. With such transparency, no stakeholder in this wheel can earn what s/he does not deserve.

We should know that once we leave the Coronavirus lockdown behind, we will be in a new world. We should understand that we will not proceed with the old methods that this new world does not deserve.

[1] The founding team of Defterhane consists of Cemil Şinasi Türün and Onur Kılıç.

Bu içerik en son 26 October 2022 tarihinde güncellenmiştir.